From Zero to Beauty Hero: A Direct Selling Success Story

3 KPIs Direct Selling Leaders Need To Be Tracking in 2023

Historically, direct selling grows during economic downturns. Amidst rising inflation and interest rates and the threat of recession, we can expect to see more people seeking flexible, alternative income streams. That means 2023 presents a real growth opportunity for direct selling companies prepared to seize the moment. But to capitalize on the possibilities of the new year, defining the right KPIs with the right performance enablement technology is critical.

What do KPIs have to do with growth? In a word, everything. If your KPIs are off the mark, your understanding of your business is, too. Measuring the right KPI’s the right way allows direct selling leaders to provide the best possible experience for their distributors by optimizing all the levers which inform their performance.

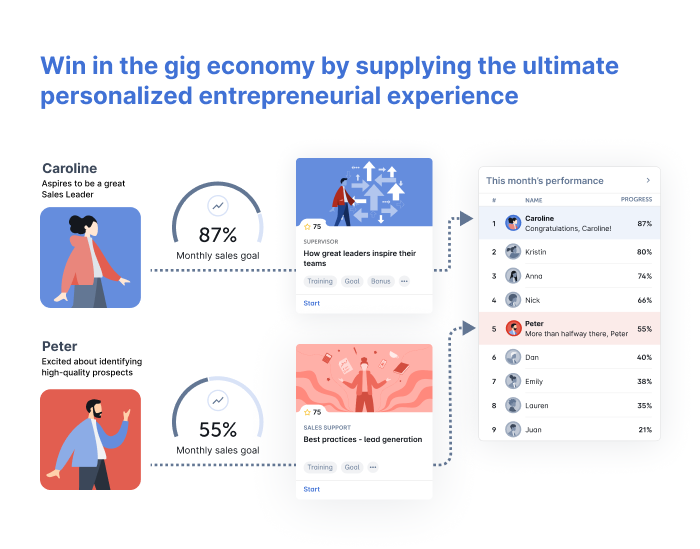

Why is this important? As the gig economy continues to siphon workforce from the direct selling industry, direct selling organizations can’t afford to work with an incomplete (thus ineffective) picture of their operations which leave distributors disengaged and dissatisfied.

So how can direct sellers define the most impactful KPIs for growth? The answer lies in depth. While most organizations are measuring top-level performance data, industry leaders like New Avon are using performance enablement technology to measure the KPIs that reveal the real story behind their outcomes.

Let’s take a look at 3 critical KPIs direct selling leaders are using and why you should be, too.

What Is a KPI, Anyway? How Does It Relate to Performance Enablement Technology?

KPI stands for Key Performance Indicator. It is a measurable value that is used to track and assess the performance of an individual, team, or organization against specific goals and objectives. KPIs are used to provide insight into whether an organization or individual is achieving their desired outcomes, and are typically tied to strategic objectives.

KPIs can vary depending on the industry, business function, and goals of the organization. Examples of KPIs for generic businesses include:

- Revenue growth: The percentage revenue increase over a distinct period of time.

- Customer satisfaction: A measure of how pleased customers are with a product or service, typically measured through surveys or feedback forms.

- Sales conversion rate: The percentage of leads or prospects that are converted into actual sales, driving revenue.

- Turnover rate: The percentage of workforce members who leave the organization over a specified period of time. This could also be called an attrition rate. It measures retention levels.

- Website traffic: The number of visitors to a website over a specified period of time. For marketing teams, this shows how much brand awareness you have at a point in time.

- Production efficiency: A measure of how efficiently products are manufactured or services are delivered, typically measured in terms of time or cost.

The selection of KPIs is important, as they should be relevant, measurable, and aligned with the organization’s goals and objectives. And the goals of the individual members of the workforce. Once KPIs are established, they can be tracked and analyzed to identify trends and areas for improvement, and to make informed decisions to optimize performance. That’s where performance enablement technology comes in. Performance enablement helps the workforce progress toward their own goals. It also helps emphasize the KPIs that matter to the organization, changing automatically. Here are some of the most important KPIs for direct selling specifically.

KPI 1: Recruiting

Especially in down economies, new direct selling distributors are eager to get started building their business right away. But after a distributor has requested a starter kit, the onboarding process is sometimes so outdated and complicated that it becomes difficult and slow for distributors to begin building their businesses. The recruiting effort might then be “for naught,” with the distributor dropping out of the field before they can even begin making commissions.

In other words, can you really be said to “recruit” individuals who either fail to complete onboarding or complete it extremely slowly?

The onboarding process at many direct selling companies is scattered and often undigitized, i.e., impersonal and hard to follow. Many direct selling companies continue to rely on paper kits filled with dense documents to onboard new distributors.

The result is many distributors end up giving up before they even begin – a huge growth inhibitor. This only becomes more true as the next generation of direct sellers — digital natives — come to the field expecting a digital, personalized, and mobile experience.

That’s why onboarding is a critical metric to measure for direct selling recruiting. Leaders understand onboarding profoundly impacts long-term recruiting results – it’s the element in recruiting that feeds into long-term sales viability and retention. But how can direct selling leaders measure this KPI?

Let’s take a look at key metrics for measuring onboarding process performance, and how direct selling leaders use the insights they produce to optimize the onboarding experience for their distributors.

1. Time to complete onboarding:

How long does it take for distributors to complete all onboarding requirements?

While many companies mail their onboarding kits and hope for the best, direct selling leaders are deliberate about optimizing onboarding completion time for efficiency so their distributors can enter the field as soon as possible. Long onboarding times can indicate a number of solvable pain points for distributors, including:

- Poor information flow is impeding distributors from moving through tasks smoothly and intuitively

- Low content quality is impeding distributors from efficiently comprehending onboarding requirements

- Decentralized resources are impeding distributors from finding the information they need to efficiently complete onboarding

These are highly solvable pain points direct selling industry leaders avoid by investing in all-in-one performance enablement technology like Rallyware’s, which uses data to personalize onboarding tasks and content all in one central location to make onboarding seamless, efficient, and easy.

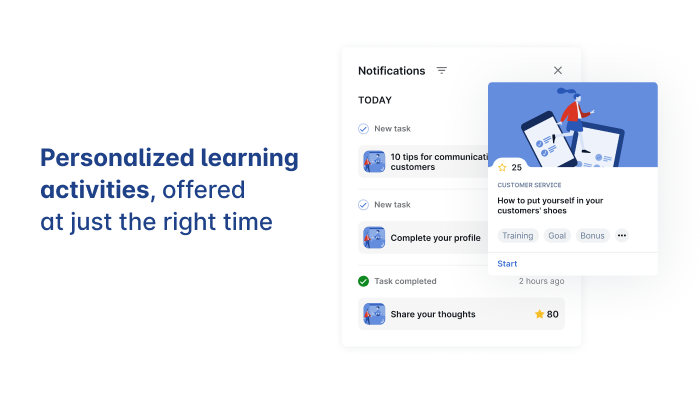

Rallyware’s platform automates onboarding so every distributor gets exactly the right task at exactly the right time— learning and task delivery is optimized by their performance data. All resources live in one simple application, so there’s no scrambling around different locations for different resources.

The math is obvious; the faster distributors finish onboarding, the faster they can begin meeting their sales goals.

2. Completion rate:

What percentage of distributors are completing onboarding?

As discussed, one of the greatest growth inhibitors for direct selling companies is distributors dropping out before they begin. This risk is only heightened by the continuing gigification of the economy. Gig work doesn’t require a long onboarding process. You sign up and can start making money pretty much right away.

Industry leaders are tracking completion rate to assess the quality of their onboarding and adapt accordingly to retain their workforce. Performance enablement technology solves for this metric by automating the right person, right time, right action for onboarding, taking the guesswork out of the process for distributors.

As Rallyware’s Dan O’Marra describes, direct selling companies must “reduce the cognitive load” for distributors to compete with gig economy, which offers easy access and startup to people looking for non-traditional work:

“The direct selling industry has had to reduce the cognitive load necessary to earn a dollar, in a manner of speaking. But you have to have smart systems to do that, to provide that experience, systems which actively guide the user toward her goals from onboarding to first sale and onward.”

Using onboarding as a KPI is critical for direct selling companies to support their distributors and compete with the gig economy.

KPI 2: Retention

If a direct selling company is constantly shedding field members, that’s a pretty abysmal situation. A more experienced, loyal field is a better-performing field. Direct selling companies have to retain their workforce in order to achieve profitability.

But what metrics go into measuring a broad term like retention? Let’s take a look at what direct selling companies are measuring to optimize for this KPI:

- Customer communication frequency: How much are distributors actively cultivating customer relationships?

Nurturing leads and connecting with customers about products is key for achieving the sales goals distributors enter the field to pursue.

At the heart of it, after all, direct selling is a relationships-centered business, and one that relies heavily on networking and human-to-human interaction. Distributors want to engage with their customers. If they’re not spending time on opportunity management, their businesses will suffer. That’s why industry leaders measure frequency of opportunity management to optimize their distributor experience.

A few factors may be contributing to low frequency of opportunity management:

- Distributors don’t know when to contact their customers

- Distributors don’t know what to contact their customers about

Industry leaders have turned to all-in-one performance enablement technology to personalize and automate every lever of distributor retention. Rallyware’s technology infuses all the capabilities of traditional CRM with performance data, surfacing the right customer relationship management action for the right person at the right time.

That means distributors receive smart triggers aligned with their goals, enabling them to nurture customer relationships intuitively and easily, another reduction of cognitive load which keeps distributors engaged and customers happy.

Smart, integrated customer relationship management surfaces personalized actions for distributors like following up, thanking, and reorder prompting.

Understanding that relationships are at the center of the direct selling business, industry leaders are optimizing for retention with opportunity management by investing in data-driven performance enablement.

- Training and upskilling task completion: How many training and upskilling tasks are distributors completing?

In an industry populated predominantly by people without formal backgrounds in sales or business, training and upskilling is particularly important for distributor success.

But training and upskilling can be a huge challenge for distributed workforces. Uplines are busy and geographically dispersed across many time zones, and, in outdated systems have little visibility into downline performance, making delivering effective training and upskilling difficult. Distributors are left with little idea of what tasks to complete and when.

Distributors must be continuously developing their skills and product knowledge in order to continue to grow and mature their business. Low engagement with training and upskilling may indicate:

- Low quality or irrelevant content is leading distributors to disengage with training

- Low quality feedback is leading distributors to disengage with training

- Decentralized resources are leading distributors to disengage with training

Many direct selling companies are using outdated LMS systems that steer users through training content in a standard, linear way. That means much of the content distributors encounter is irrelevant to their needs. When users feel their training isn’t useful, it only makes sense they’d stop engaging with it.

Low quality feedback is another retention killer. When it comes to training and upskilling, distributors want to feel they’re making progress and confident that they’re on the right track. Not only that, but training and upskilling is a continuous process. To sustain continuous engagement with training and upskilling, companies must provide continuous feedback around progress. When this doesn’t happen, distributors lose motivation and disengage.

As in all elements of the distributor experience, decentralized resources are toxic to this KPI. Distributors are busy building their businesses, often in the hours outside of other commitments. If they can’t find the training and upskilling resources they need in one location, they’re unlikely to spend much time looking. As development and skill-building goes by the wayside, so does engagement with their business success, and then retention follows.

Low engagement with training and upskilling translates directly into disappointing business outcomes for distributors, beginning a slippery slope toward exiting the field.

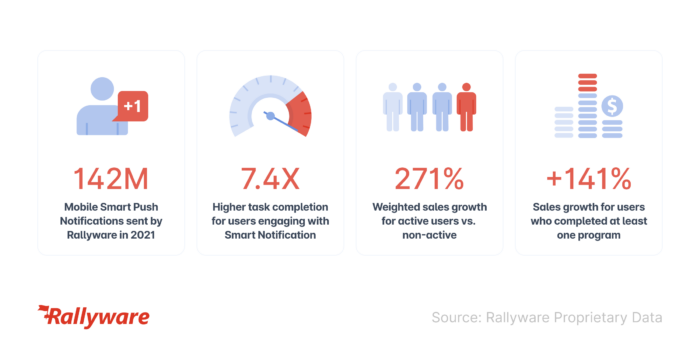

That’s why industry leaders use Rallyware to update their training processes from old LMS systems to complete, data-driven performance enablement. Rallyware’s platform allows user data to travel back and forth between all functions of distributor business, surfacing the right training and upskilling task to the right person at the right time, guaranteeing relevance to distributor needs in an intuitive, easy to use DX.

On the Rallyware platform, progress boards and gamification elements like “badges” provide distributors with continuous, personalized feedback. They’re never left wondering what to do or where they are in relation to their goals. In 2021, Rallyware saw an average of 23% increase in digitized achievement rewards after introducing enhanced progress visualization tools, and a 23% increase in tasks accomplished.

By investing in downline engagement, direct selling leaders are investing in the retention of their workforce. The results are undeniable. Amanda Roberston, Head of Learning and Development at Avon, says, “Rallyware has helped our company streamline a single training location for all learning elements. We have been able to establish a true AVON U community and watch it grow not only in technology and content, but learning, KPIs and genuine Representative feedback on how the training is helping them in their businesses.”

KPI 3: Sales

Direct selling leaders know there’s much more to sales numbers than meets the eye. A top level sales figure is just the tip of the iceberg when it comes to understanding and optimizing business outcomes for uplines and downlines.

What are direct selling leaders measuring to really understand this crucial KPI? Let’s take a look.

- Time to sales goals completion: How long is it taking distributors to meet their sales goals?

Distributors enter direct selling with individual sales goals. Some may be looking for full-time income while others may be seeking community and product discounts. An organization comparing only monthly sales among its downlines is missing the picture.

Time to individual sales goal completion gives direct selling companies a real picture of sales productivity. If time to sales goal completion is too long, distributors are likely experiencing sales productivity frictions which may lead to leaving the field. Factors leading to long sales goal completion times include:

- Inconsistent engagement with customers

- Confusion about how to sell certain products

- Confusion about what steps to take in order to meet sales goals

To return to the idea of reducing cognitive load and the nature of direct selling work, the fact is that many distributors need more guidance than they’re currently provided in order to meet their sales goals. With limited sales training and busy schedules to work around, direct selling companies must make it as easy as possible for distributors to meet their sales goals.

Integrated performance enablement technology triggers right action, right time, right person notifications so distributors know exactly what to do to meet their sales goals. Progress visualizations keep their goals top of mind while gamification elements like leaderboards and badges reward incremental progress, keeping motivation high.

- Incentive completion: What percentage of distributors are completing incentive and promotion initiatives?

Much of direct selling relies on incentives and promotions. But at what rate are distributors actually completing these incentives? This metric helps direct selling companies assess whether their incentive and promotion programs are actually driving the positive behavior change they want to see in distributors. Low completion rates indicate:

- Distributors aren’t sufficiently aware of incentives

- Distributors aren’t motivated by the incentive structure

- Distributors aren’t sure how to meet incentive goals

In these cases, the automated notifications of performance enablement technology saves the day again for distributors, while the powerful analytics available to uplines allows them to adjust incentive and promotion structures for better results.

Ready to increase your KPIs in 2023 and beyond? Request a demo of Rallyware’s all-in-one performance enablement platform today.

News and Insights on Workforce Training & Engagement

We’re among top-notch eLearning and business engagement platforms recognized for effective training and talent development, helping to empower distributed workforces

Subscribe